The Covid-19 pandemic was the reflection point for the PropTech sector. For the first time change in the property sector that no analyst could have ever expected in their wildest predictions needed to happen. Buildings completely empty, a sector that had no idea what was happening, a sector that had been asleep at the wheel for so long that nobody had really looked at how these buildings were really managed.

The pandemic put the focus firmly on those of us in the PropTech sector that had been pushing our technologies hard to many companies. Many of us struggled with the massive uncertainty that befell the sector, but huge focus was put in by those of us who knew the real issues faced by our clients. What the pandemic has delivered is greater clarity on the need for property technology to be embedded in all commercial buildings.

With Putin’s invasion of Ukraine, general signs of a deep recession, energy costs up 400%, buildings can no longer be run the way they were pre-pandemic. The reason the PropTech sector is now so important is property owners are flying blind.

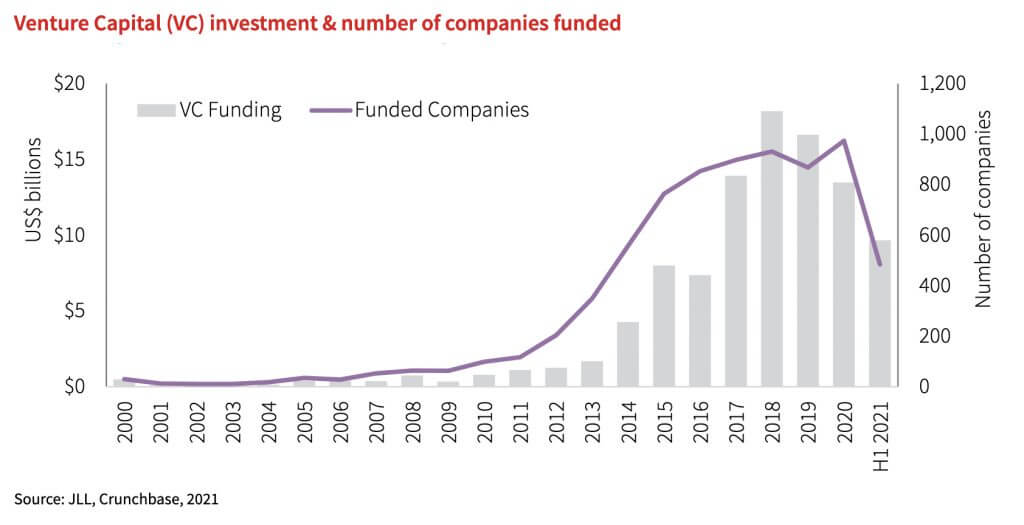

With the focus from COP26 and looming net-zero targets, as well as severe taxation and legislation in many countries for more sustainable buildings, there has never been a better time for the PropTech sector. This is why the venture capital investments are now piling in to find the gems.

For PropTech companies, particularly startups, investors can see a solid need for change in these concrete jungles. Record-breaking amounts are being poured into the sector by investors. The sector is delivering, too, with 85% stating that investors have seen PropTech companies meet or exceed expectations.

$4 billion of investment has been spent on PropTech just Q1 of this year, solidifying that the sector is only looking to grow upwards. 57 PropTech mergers and acquisitions (M&A) deals have been announced in just this first quarter. Tishman Speyer has announced a $100 million PropTech VC and recently CBRE, JLL Spark, and Cushman & Wakefield have invested $400M, $363.8M, and $115M respectively in PropTech deals and PropTech incubator EGX has just raised $100 million.

This upsurge in investor confidence has a direct correlation to the pandemic. As hybrid and remote working quickly became the norm, building occupancy numbers rapidly decreased. The commercial real estate industry had to change, and it had to change quickly. Digitisation is a popular buzzword in the current climate of the CRE sector, and a slew of PropTech companies have been vying for investor dollars.

Governments worldwide are commencing stricter regulations for commercial buildings, and PropTech services are forerunners in providing systems that help companies veer away from the financial obsolescence that looms over non-green buildings. Management systems that measure sustainability and energy efficiency are becoming increasingly common and expected in commercial properties, and PropTech companies are the sector’s main suppliers.

Money is flooding into PropTech at an unprecedented rate right now, with a boom in innovative technologies to target the problems faced.

Share your thoughts

No Comments

Sorry, the comment form is closed at this time.