Are we all losing our common sense?

ESG – Environmental, Social, and Governance – regulations are vital in holding the corporate world responsible for the mass amount of CO2 it produces each year. Without them in place, companies could run even more rampant and we could be seeing even faster climate degradation.

But not everyone agrees on this. Despite the climate crisis we are already seeing unfold before us, governments are far more comfortable with burying their heads in the sand and continuing to pump out mass amounts of carbon emissions.

Several Republican-led states are forging anti-ESG paths. Last year, Texas enacted a law that barred several large corporations from doing business in the state due to their ‘boycotting’ of fossil fuel companies. Included in this ban were enterprises like BlackRock, BNP Paribas, and Credit Suisse, among others. In July this year, West Virginia followed suit, banning big banks like JP Morgan Chase and Wells Fargo from making financial contracts.

Then in August, Florida Governor Ron DeSantis banned state pension funds from incorporating ESG factors into their investments.

For all of these states, their reasonings are much the same. To them, ESG is another extension of woke, liberal culture and will have an adverse effect on the economy. However, to many, this is just another example of how deeply governments are intertwined with the fossil fuel companies that are responsible for the climate crisis.

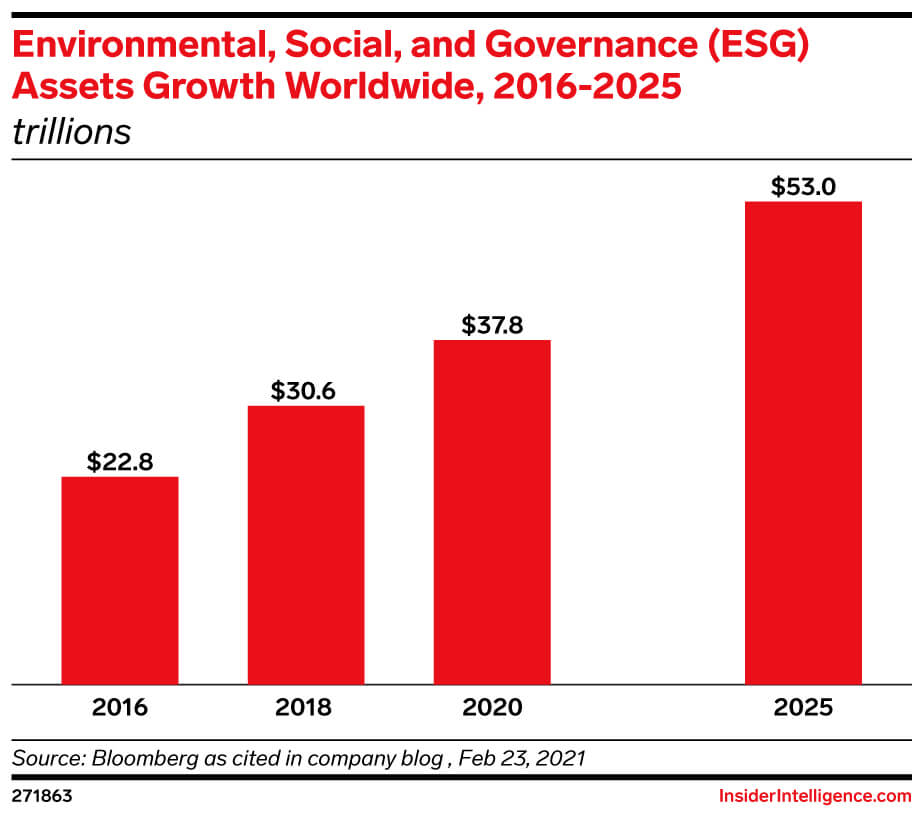

In a post-Paris Agreement world far more focused on sustainability and carbon emissions, incorporating environmental, social, and governance regulations is often the first step for companies looking to demonstrate corporate responsibility. The numbers reflect this. Globally, the value of assets that are managed under ESG principles currently equals over $30 trillion and, by 2025, 33% of global assets will have ESG mandates. By 2036, it is estimated that these assets could rise to $160 trillion. It is clear too that investors are consistently awarding bigger sums to companies with higher ESG scores.

The fossil fuel industry and ESG investment are not entirely mutually exclusive. A good chunk of Wall Street firms donate billions towards fossil fuel companies. Many fossil fuel producers are also implementing ESG strategies themselves, to reap the benefits of credits for carbon capture and other green projects. Although, as we’ve discussed before, this is a murky practice.

Perhaps governments in the States should look to Europe who, on the whole, have much stricter ESG policies. In France, for example, financial institutions have been required to disclose climate- and biodiversity-related risks and impacts since early 2021. Across the entire EU, investment corporations now need to disclose activities that have a negative impact on biodiversity-sensitive regions.

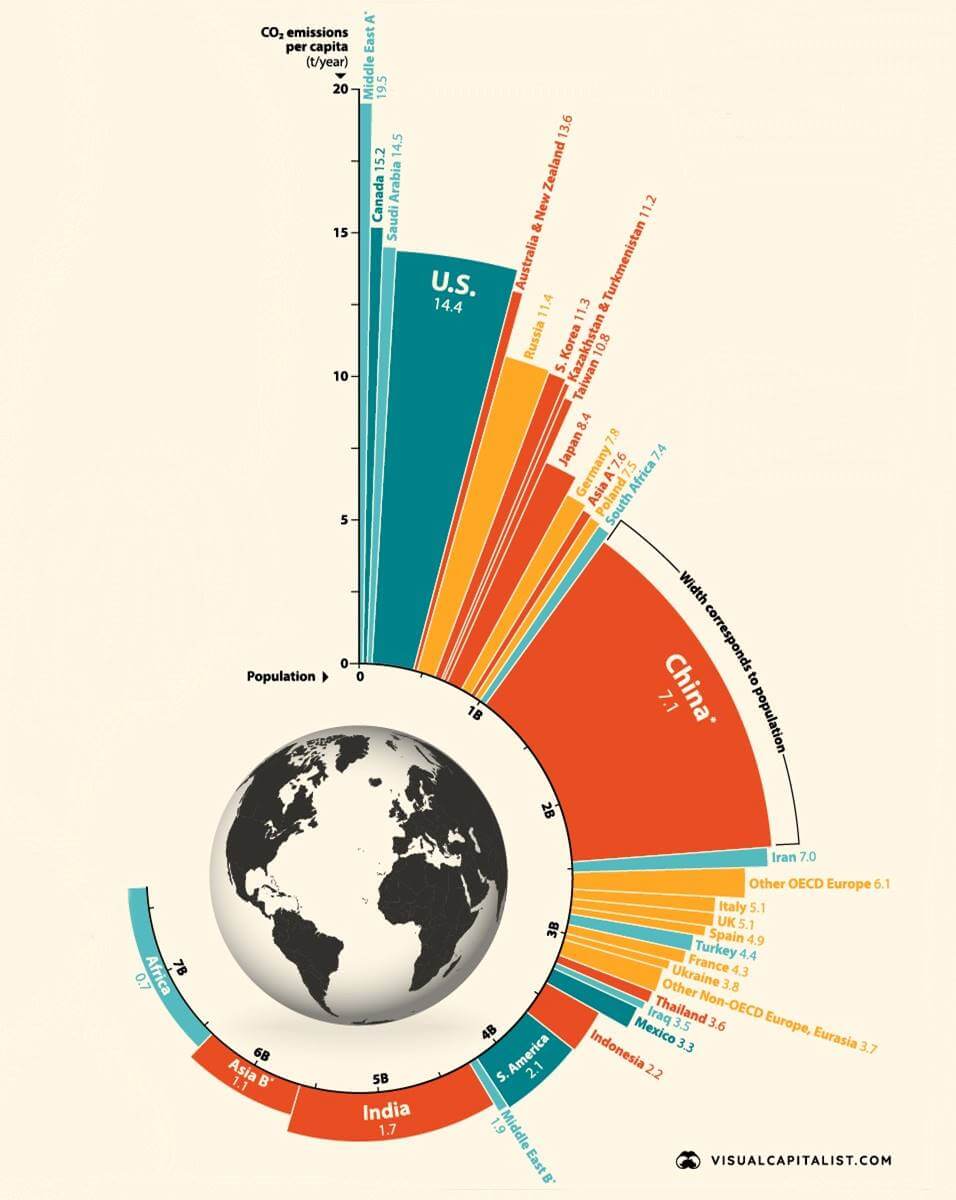

Here is the reality of CO2 emissions per country:

- The Middle East – 19.5 tonnes per person

- The US – 14.4 tonnes per person

- China – 7.1 tonnes per person

- The UK – 5.1 tonnes per person

Ultimately, whether the anti-ESG bandwagon is being used for political fodder or not, it’s only pushing us backwards when we need to be rapidly pushing forwards. The more time we spend going to and fro on whether ESG is liberal propaganda, the less time we are spending actually taking the steps to reduce our global emissions.

There simply isn’t time for constant talking and debate anymore. We have to take rapid climate action, before we reach a point where our efforts become useless.

Share your thoughts

No Comments

Sorry, the comment form is closed at this time.