Big corporations and authorities are at war. The battlefield? ESG.

Those who are really paying attention know that the way commercial buildings operate has to radically change, and the hands of companies need to be forced to make our cities greener. Buildings need to be updated with one thing primarily in mind: sustainability. Not only does an unsustainable building suffer financially, it’s actively contributing to the rising global temperatures around us.

Governments are closing ranks around some of the biggest companies in the globe in an effort to curtail corporate greenwashing. In April, the SEC began investigating $725 million of assets from Goldman Sachs and, in May, Deutsche Bank’s offices in Frankfurt were raided by police. Both firms have been accused of fraudulent ESG and greenwashing claims.

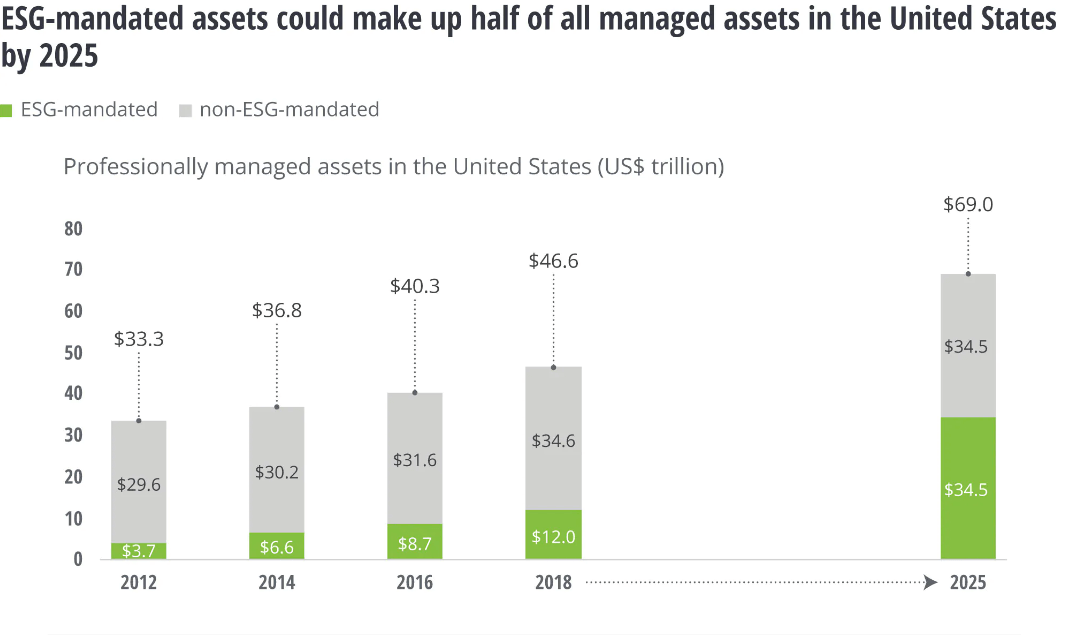

ESG is dominating the commercial real estate sector. Three letters have sent slow-moving CRE into a scramble to increase its sustainability. Environmental, Social and Governance targets are rapidly becoming one of the main focuses of commercial buildings, and everyone from investors to governments are expecting buildings to be more sustainable, more employee-centric, and more cost efficient.

As we’ve already discussed, only 4% of London office buildings are currently operating at the EPC (Energy Performance Certificate) standards that the UK government will introduce in 2023. Many in the CRE sector are fumbling blindly around sustainability, preferring to employ greenwashing tactics and pay lip service to the subject instead of actually taking action for change. This needs to change, and fast.

Dedication to ESG is becoming increasingly more expected of commercial buildings. For investors, funding green buildings is more rewarding in the long run, and buildings that aren’t sustainable are facing difficulties – from missing out on investment to receiving so-called ‘brown discounts’. Commercial buildings that stick to net-zero targets show an increase of 5-12% in value, compared to a 30% drop for non-sustainable buildings.

Occupiers, too, want to be in buildings that aren’t mass carbon emitters or detrimental to their health. This has become an even bigger issue with the trend of hybrid working and decreased occupancy rates since the start of the pandemic. As much as office workers don’t want HVAC systems overpowered and emitting unnecessary carbon, they also don’t want to be sitting freezing or sweltering at their desks as air conditioning or heating is blasted into a floor with only five employees.

Governmental regulations are also being reinforced. In April, Britain also became the first G20 country to make ESG disclosure mandatory across 1300 UK companies. Shortly after, the UK ministry’s green finance unit started discussions with the Financial Conduct Authority to tackle greenwashing. This comes after the International Organisation of Securities Commissions (IOSCO) stated that ESG verifiers should undergo stricter regulations from national watchdogs. Similarly, in the US, investment banking company BNY Mellon was recently sued by the SEC and ordered to pay $1.5 million for misstatements regarding ESG investments. The regulatory noose is tightening around the necks of companies and developers who aren’t putting sustainability at the forefront of their operations.

The ESG journey doesn’t come without its difficulties, however, particularly as landlords and developers scrabble to avoid value decreases and taxation. These difficulties could have the knock-on effect of significantly slowing CRE’s journey to sustainability. For example, an estimated 350,000 additional employees will be required to cover growing ESG demand by 2028. The lack of sustainability professionals is going to be a significant hurdle for many commercial buildings and companies wanting to achieve sustainability targets.

Fortunately, retrofitting buildings with greener construction materials and technology has become a leading solution in the de-carbonisation of the CRE sector. Property group Grosvenor pledged in April to invest £90 million in retrofitting their London portfolio, which includes 500 grade I and II-listed buildings. Even simple retrofits can have a massive positive impact on a building’s operations, reducing carbon emissions by at least 20% if implemented efficiently. On top of that, energy expenses can be reduced significantly, by anywhere between 15-40%.

There needs to be a complete green overhaul of commercial real estate and, until the sector removes its own head from its proverbial backside, change isn’t going to be seen and people with their own agendas will be running the ESG conversation.

Share your thoughts

No Comments

Sorry, the comment form is closed at this time.