The housing bubble is going to pop.

We’ve been here before. Flashback to 2007: house prices in the US rapidly declined as a result of buyers defaulting on mortgages that, realistically, were well beyond their means. The bursting of the housing bubble crashed the global economy and led into the Great Recession in the early 2010s.

Governments bailed out the banks? Wrong, we, the taxpayers, bailed out the banks.

And now it’s happening again, globally – a result of the Covid-19 pandemic has crushed the global economy in ways no financial analyst could have ever predicted. Quantitative easing is a nicer way of stating that governments are just going to print more money, that we the taxpayers are going to finance, to bail out economies. Inaction and political positioning to try and keep democracies appeased and ensure these governments are elected the second time around is the core issue.

Countries across the globe are now looking down the barrel of a deep recession, and the strain on housing is just the start. The reason we are hitting double-digit inflation, the reason why there is so much uncertainty, is a knock on effect of amongst other things global logistic supply chain issues and of course the Ukraine war. But let’s not forget why we’re here – we did not learn the lessons of the last crash.

The UK’s housing prices have seen a year on year inflation increase of well over 10%, a figure scarily similar to those preceding the last recession. People are taking out mortgages far above and beyond what they can afford – and they’re being allowed to do it. The average house in the UK is currently valued at £273,762 and, just in the last year, average house prices rose £28,000. In London, where the market is most volatile, the average house price is £670,000, with the average salary for full-time employees being approximately £39,000. So the traditional multiples of 2.5 joint, and 3 single borrowing simply do not work for the vast majority of people.

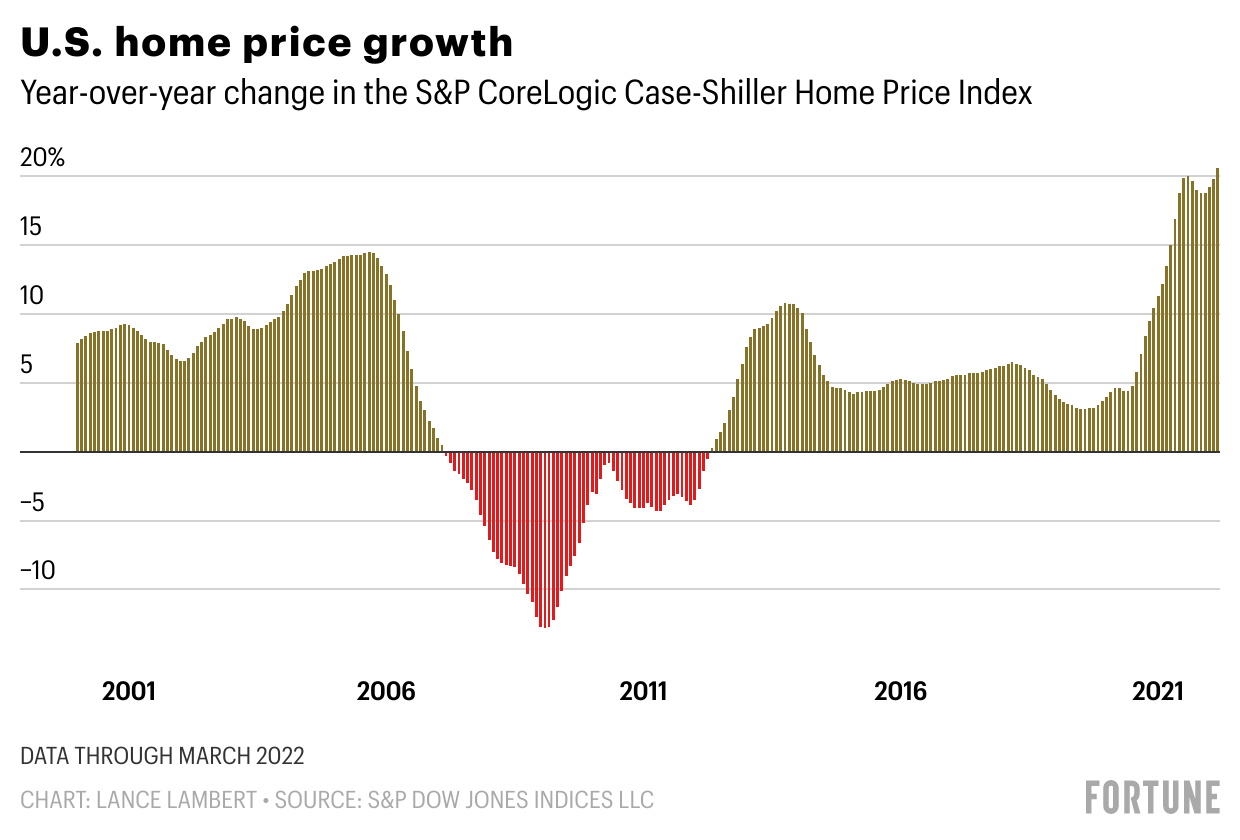

This is a worldwide problem, too. In the US, house prices have risen 19.8% over the past 12 months, 4x what the annual average has been since 1987. All of the top 100 American housing markets are overpriced as compared to what people are earning. This is worse than what happened in the 00s. Currently, US house prices are significantly higher than just before the subprime crash. The recession that’s to come will undoubtedly be even more devastating.

And it’s not just mortgages, rental prices are also soaring beyond people’s means. The UK monthly rent, on average, is around £910, with Greater London prices much higher than other regions at £1752 pcm. The dramatic hike in housing prices has forced many to rent for life, unable to save for deposits to ever gain a mortgage. Skyrocketing rental prices are leaving tenants without the certainty that comes with ownership of their home.

In the US, monthly rent across the country has increased by 17% in the last year, reaching $1940 in March. US inflation has risen 8.5% in the past year, and UK inflation has risen to above 9%. At the same time, the income of the UK’s poorest decreased by 2% between the financial year ends of 2020 and 2021, now a median of £14,600. As the economy continues to worsen, housing and rental prices are somehow still increasing. The lessons of 2007 have not been heeded. The bubble is primed (or should I say sub-primed) to pop.

Ultimately, we’ve got no excuses. This is happening for the second time in just over a decade. This time, however, we’ve had two years of devastation due to Covid-19. Homeowners and businesses are seeing their energy bills, mortgage payments, and rents skyrocket, and these prices show no sign of curtailing anytime soon.

For every 1% increase in unemployment, 40,000 people die.

Those responsible for allowing housing prices to increase this dramatically MUST be held accountable. The world is entering into overwhelming debt, and the public are being fooled by the manipulation of the truth dressed up in new financial buzzwords such as quantitative easing.

We can hope that a global downturn is not going to happen. We can hope that a magic pill will come along. But the metrics paint a very bleak picture. It is essential that governments convey the difficult policy choices that must be delivered for long-term sustainable growth. We need to focus on society that delivers more equality, not one with a focus on getting rich through financial manipulation which makes property ownership impossible for most.

Share your thoughts

No Comments

Sorry, the comment form is closed at this time.